what is suta tax rate for california

As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021. Standard rate 257 207 employer share.

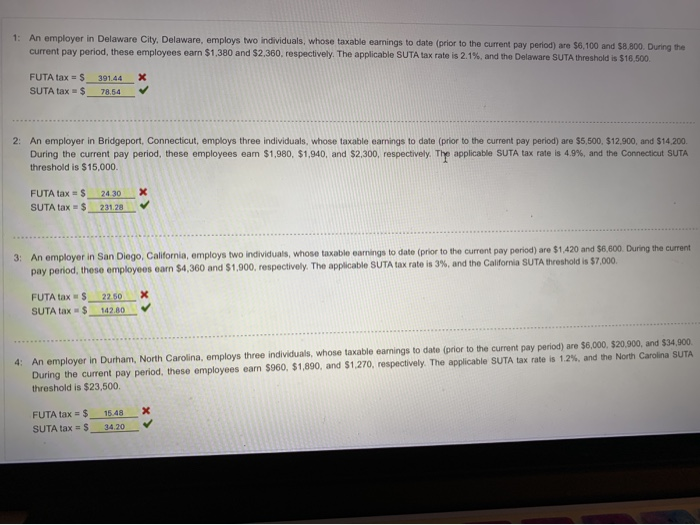

Solved I Fugured Out Suta But Need Help Finding The Futa Tax Chegg Com

Unemployment benefit tax.

. State unemployment tax rates. 52 rows Most states send employers a new SUTA tax rate each year. The new employer SUI tax rate remains at 34 for 2021.

Generally states have a range of. What is the current SUTA rate for 2020. When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the.

For example if you own a non-construction business in California in. 065 68 including employment security assessment of. With the Taxable Wage Base Limit at 7000 FUTA Tax per employee 7000 x 6 006 420.

SUTA State Unemployment Tax Act. SUTA dumping is a tax evasion scheme where shell companies are set up to get low UI tax rates. The amount of the tax is based on the employees wages and the states unemployment rate.

The SUI taxable wage base for 2020 remains at 7000 per employee. When it comes to SUTA tax employers should know about the SUTA tax wage base and state unemployment tax rates. New Hampshire has raised its unemployment tax rates for the second quarter of 2020.

Tax rates for the second quarter. Effective January 1 2022. To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base.

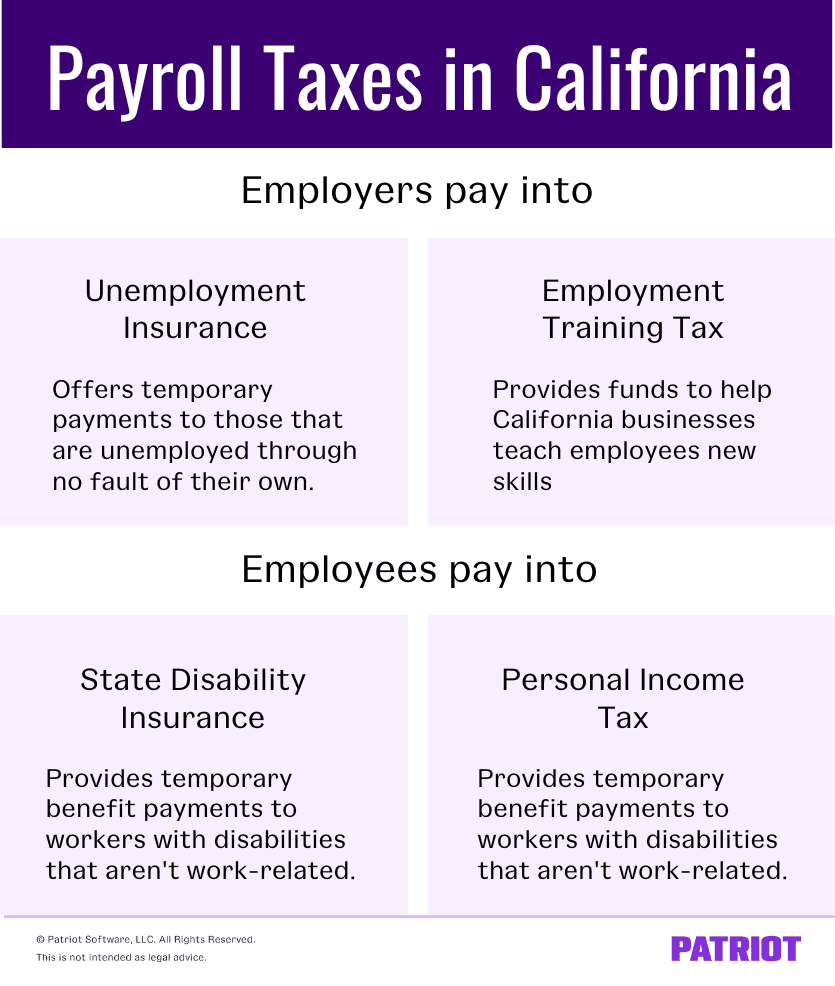

There is no taxable wage limit. State SUTA new employer tax rate Employer tax rate range SUTA wage bases Alabama. California PIT is withheld from employees pay based on the Employees Withholding Allowance Certificate Form W-4 or DE 4 on file with their employer.

4 rows Imagine you own a California business thats been operating for 25 years. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. For example if you own a non-construction business in California in.

Each state sets a SUTA tax wage base for employers. SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages. To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base.

Your state agency will send out a notice with your assigned SUI tax rate when you first. FUTA Tax per employee Taxable Wage Base Limit x FUTA Tax Rate. The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website.

The 2020 California employer SUI. In the State Tax Information information find your SUI rate.

What Is Futa Tax 2021 Tax Rates And Information

2022 Federal Payroll Tax Rates Abacus Payroll

A Complete Guide To California Payroll Taxes Rjs Law

California Tax Rates Rankings California State Taxes Tax Foundation

2022 Federal State Payroll Tax Rates For Employers

Understanding California Payroll Tax

Idaho 2022 Sales Tax Calculator Rate Lookup Tool Avalara

California Tax Rates Rankings California State Taxes Tax Foundation

Understanding The Governor S 2022 23 May Revision California Budget And Policy Center

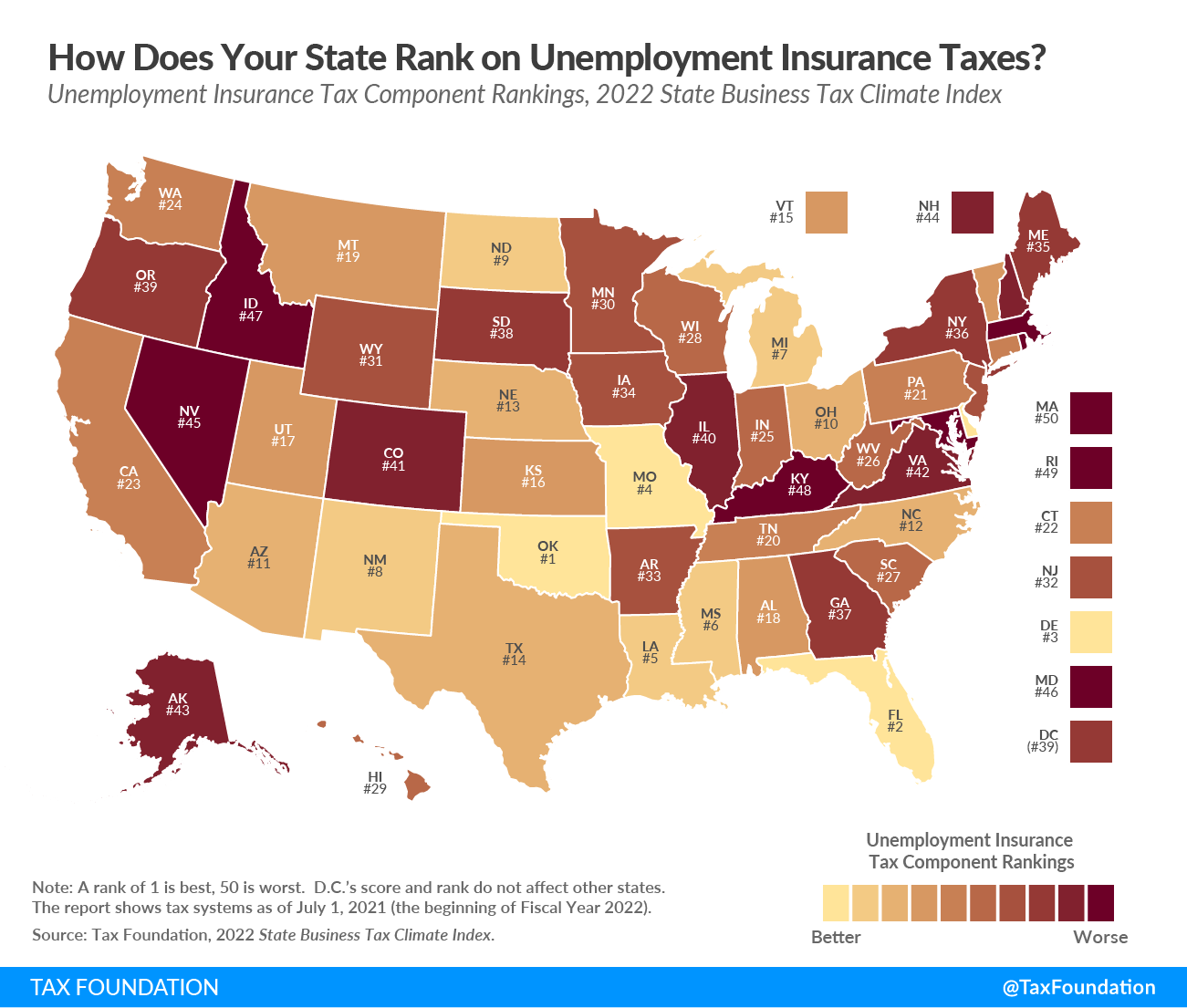

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

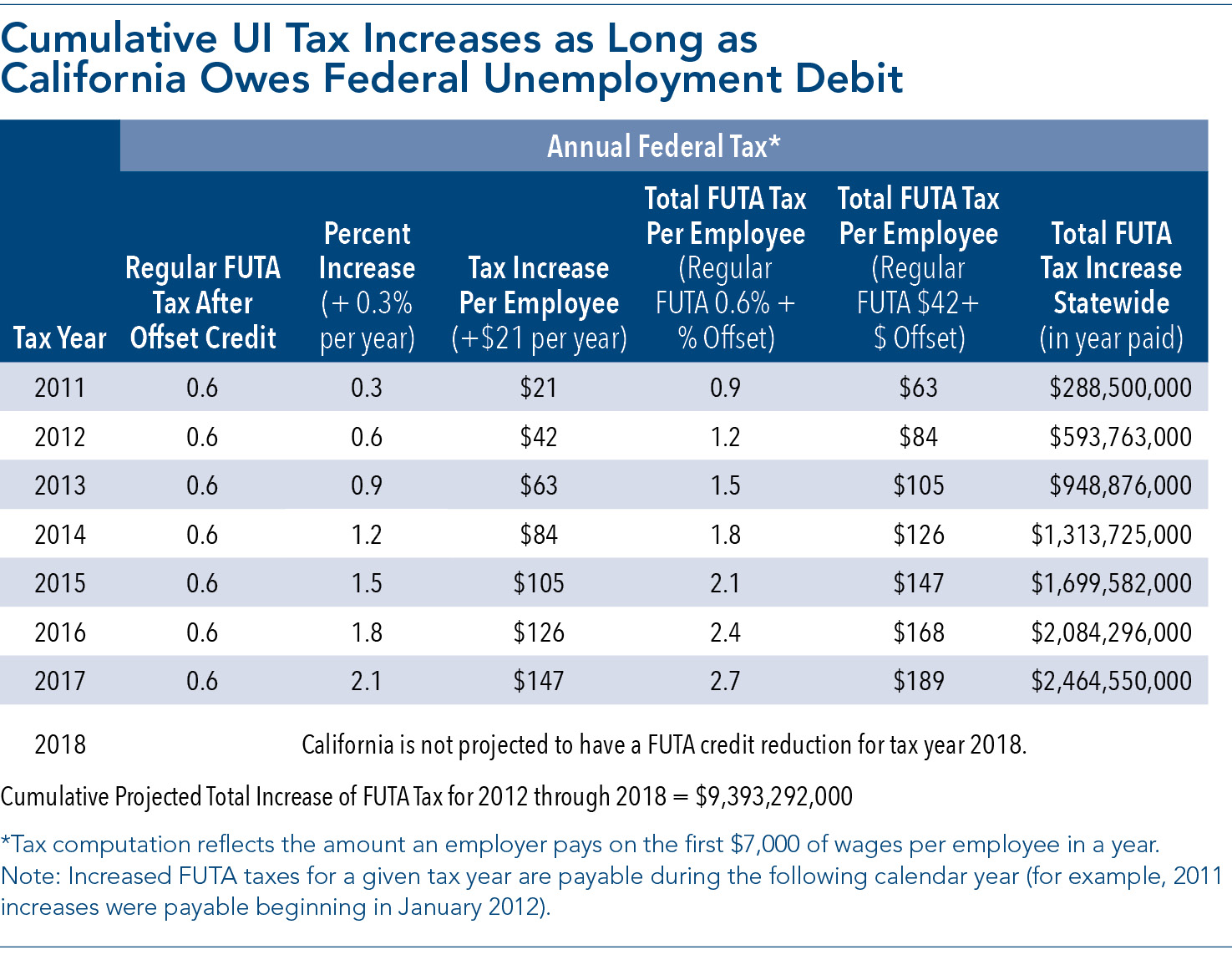

Futa Rate Increases For California Infographic

A Complete Guide To California Payroll Taxes Rjs Law

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Historical California Tax Policy Information Ballotpedia

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

Federal Unemployment Insurance Taxes California Employers Paying More Calchamber Alert

Suta State Unemployment Taxable Wage Bases Aps Payroll

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

California Nonprofits Unemployment Insurance Changes Ahead You Have Options First Nonprofit Companies